Flood insurance puts the ‘un’ in unaffordable insurance

14 November 2024

“The most significant driver of affordability stress is exposure to flood risk. At an Australia-wide level, flood premiums are 2% of premiums for non-stressed households but 15% for affordability-stressed households. The average flood premium paid by stressed households is nearly 16 times higher than that paid by non-stressed households.”

— Home Insurance Affordability and Home Loans at Risk (Actuaries Institute 2024, p17)

The August 2024 report by Actuaries Australia titled ‘Home Insurance Affordability and Home Loans at Risk’ confirms many of the issues people are facing in insurance, but the surprise is flood insurance.

Key messages:

Sharp Increase in Insurance Affordability Stress: As of March 2024, 15% (1.61 million) of Australian households are under "insurance affordability stress," meaning they spend over four weeks of income on insurance premiums. This marks a 30% increase in affected households from just one year prior (1.24 million).

Impact on High-Risk Properties: Premiums for the 5% of households with the highest risks have surged by over 30% in just a year. These costs primarily arise from increased reinsurance costs due to climate risks and higher building costs, putting pressure on these households

Regional Variability: Certain areas, like Northern Rivers (NSW) and parts of Northern Australia, face extreme insurance affordability stress, driven by risks from cyclones and floods. In some regions, over 40% of households experience affordability stress.

Home Loan Vulnerabilities: About 5% of households with home loans face severe insurance affordability pressures, representing $57 billion in loan balances that are at risk. If insurance costs remain unmanageable, this could affect lenders' portfolios due to loan defaults, particularly in regional areas with high natural peril risks.

Potential for Non-Insurance and Loan Implications: Lenders typically require borrowers to maintain insurance, but this report suggests that a growing number of borrowers might forgo insurance due to high premiums. This could jeopardize loan security, especially for smaller lenders with regional concentration, increasing systemic risks across the lending market.

That is all news that we have heard before.

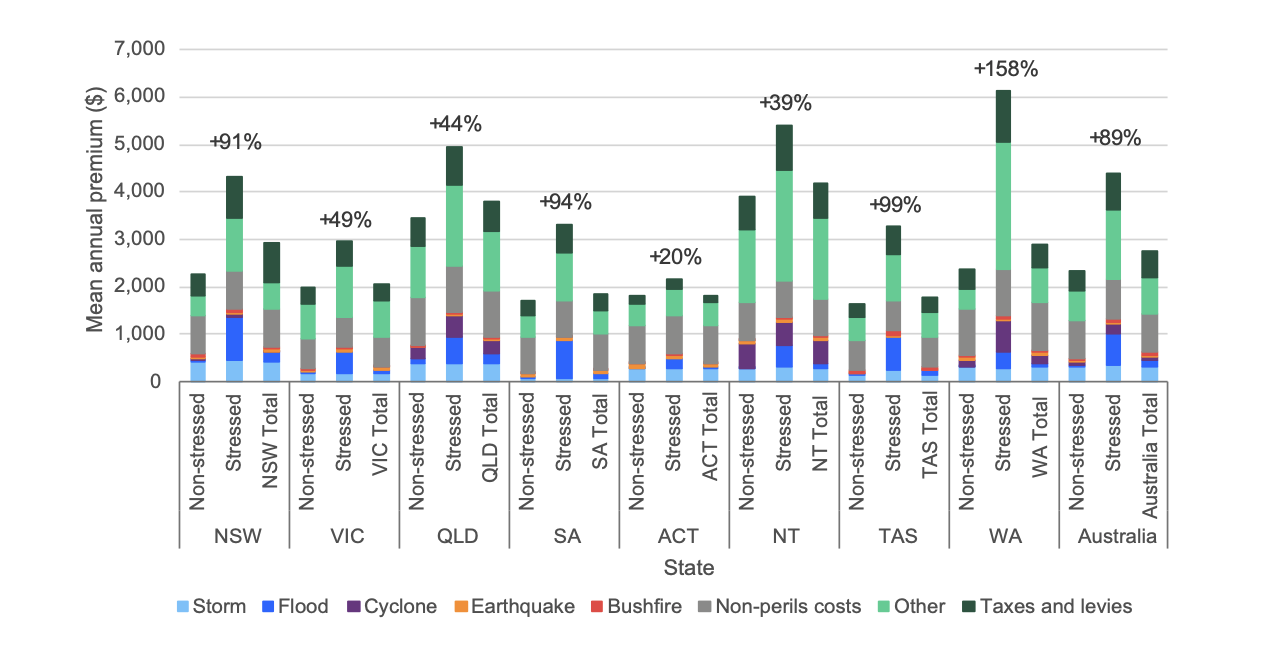

What is concerning about the impact of floods on home insurance affordability is hidden in the chart below. It shows that the flood insurance component of stressed households is significantly greater than the flood insurance component for non-stressed households in every state.

There is no place in Australia where stressed households are paying a lower flood insurance premium as a portion of their total premium.

It is also the only visual way to differentiate between stressed and non-stressed. If the dark blue is big, then the household is stressed.

Image: Figure 3.4 - Total insurance premiums by state, split into stressed and non-stressed (Actuaries Institute 2024, p16)

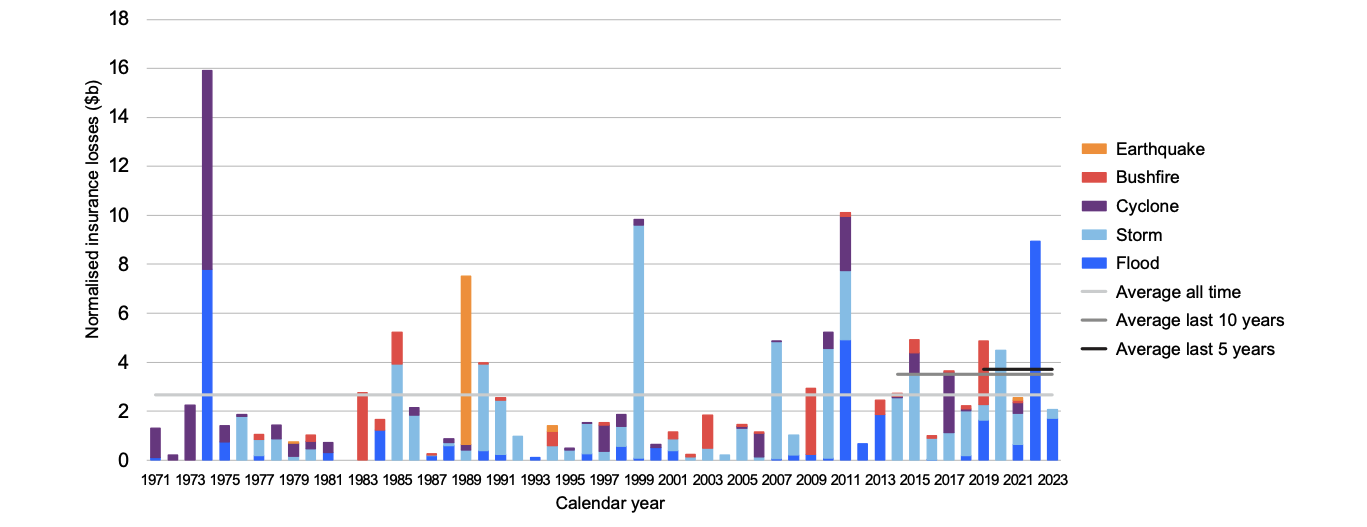

The report then states that the rise in premiums, increasing unaffordability for many Australians, will continue given the recent increase in insurance losses.

Image: Figure 6.2 – Normalised historical insurance losses in Australia (Actuaries Institute 2024, p28)

Floods and storms have clearly driven a rise in recent insurance losses with the 2022 floods driving the highest losses in over a decade.

The flood insurance premium component of home insurance will not be reducing any time soon.

What happens next year if we have reached the point where more than 20% of households fall into insurance affordability stress? And the year after that?

Sebastian Vanderzeil is an economic advisor, member of WECA & Resilient Kurilpa.

Article originally published on Strabo Rivers on 14 November 2024.